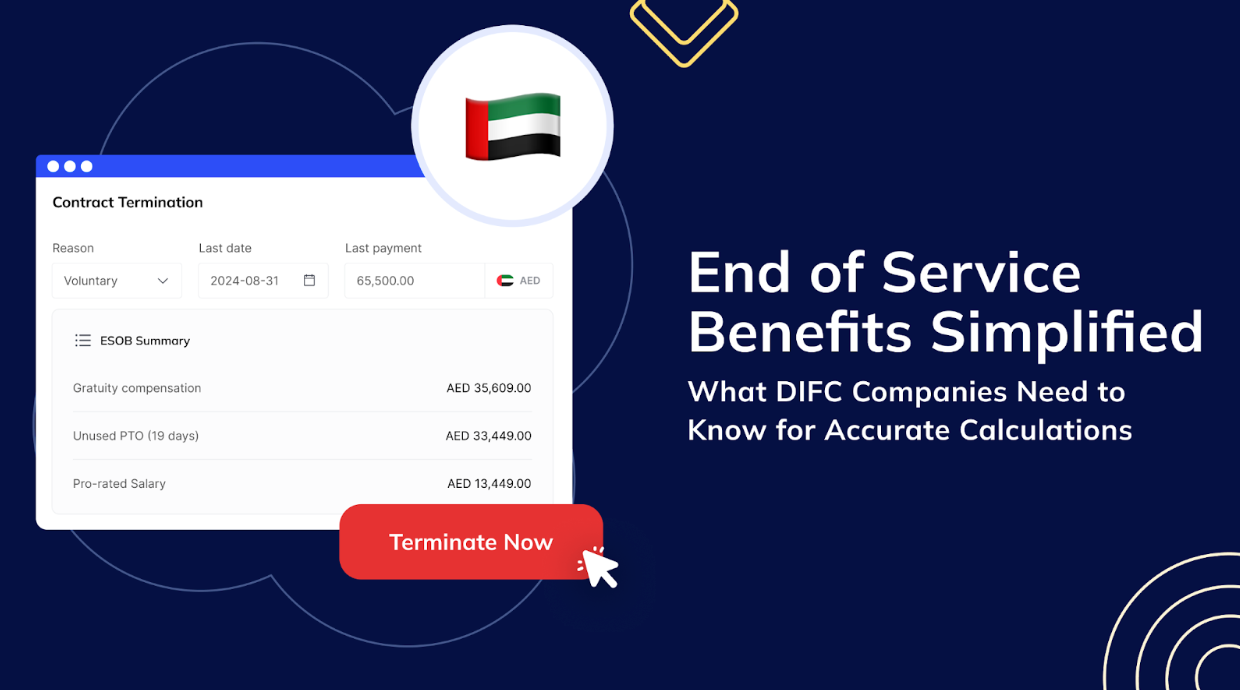

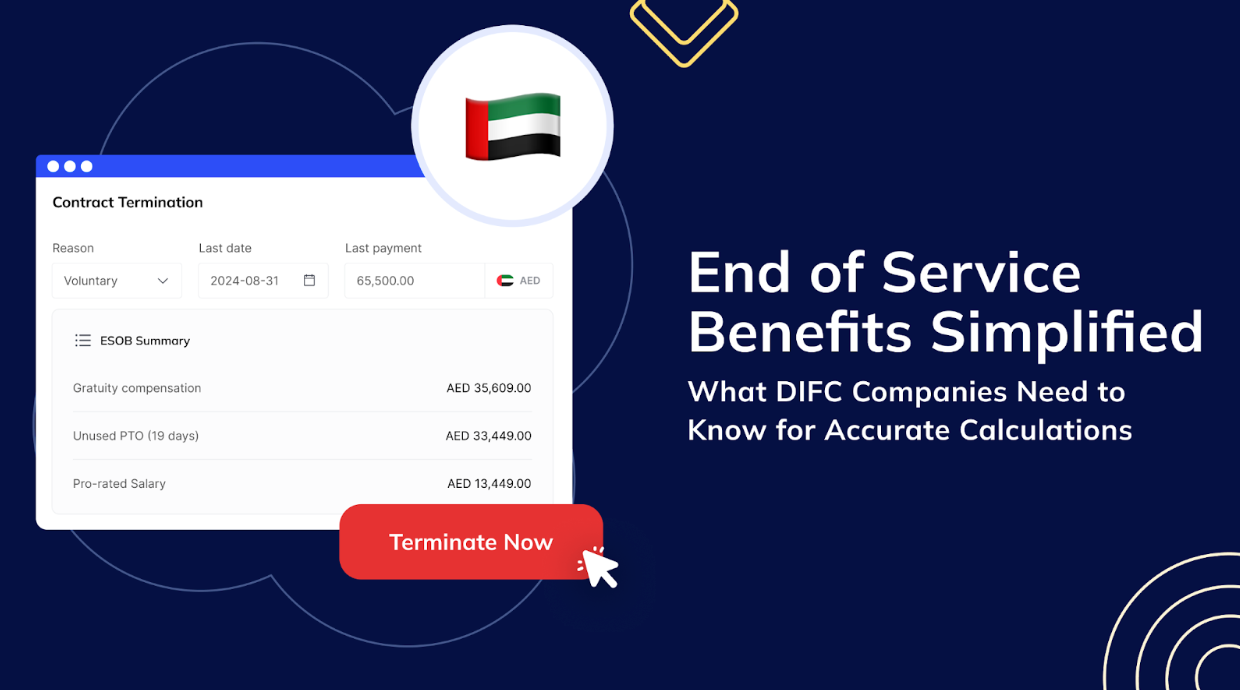

A Complete Guide to End-of-Service Benefits in Dubai: Ensuring Compliance and Employee Satisfaction

End-of-service benefits (EOSB) are a fundamental aspect of employment in the UAE, reflecting the commitment to protecting employees’ rights while fostering a productive workplace environment. These benefits, governed by UAE labor law, are crucial for businesses to manage effectively to ensure compliance and maintain employee satisfaction. Young and Right Accounting and Tax Consultancy, recognized as one of the best accounting firms in Dubai, offers expert guidance and solutions to help businesses streamline the management of EOSB.

What are End of Service Benefits in Dubai?

End-of-service benefits are gratuity payments made to employees upon the termination of their employment contract. These benefits are mandatory under UAE labor laws and are calculated based on the employee’s length of service and last drawn salary.

The Federal Decree Law No.33 of 2021 governs end-of-service benefits in the UAE, establishing the regulations that businesses must follow to ensure compliance.

Introduction to End-of-Service Benefits

End-of-service benefits are a crucial aspect of employment in the UAE, providing financial compensation to employees upon the completion of their employment contract. These benefits, mandated by UAE labor laws, ensure that employees receive fair compensation for their service. Understanding end-of-service benefits is essential for both employers and employees to ensure a smooth transition and compliance with UAE labor laws. In this section, we will provide an overview of end-of-service benefits, including the types of service benefits, calculation methods, and process and documentation requirements.

Types of Service Benefits

There are several types of service benefits that employees may be entitled to in the UAE, including:

Gratuity Payment: A lump sum payment based on the employee’s basic salary and duration of service.

Leave Encashment: Payment for unused annual leave days.

Carry-Forward Annual Leave: Payment for unused annual leave days carried forward from previous years.

Notice Period Salary: Payment for the duration of the notice period or payment in lieu of notice.

Other Benefits: May include bonuses, allowances, or other benefits as per the employment contract or company policy.

These service benefits ensure that employees are compensated for their contributions and any unused entitlements, providing financial security at the end of their service.

Key Components of EOSB

Eligibility

Employees must complete at least one year of continuous service to qualify for EOSB.

Calculation

The EOSB amount is calculated based on the employee's basic salary as specified in the employment contract and tenure.

Payment Terms

EOSB must be paid promptly upon contract termination, as stipulated by UAE labor laws.

Deductions

Employers can deduct certain amounts if the employee fails to meet contractual obligations.

Importance of End-of-Service Benefits

1. Compliance with UAE Labor Laws

Managing EOSB in accordance with UAE labor laws and understanding labor law provisions ensures businesses avoid legal penalties and disputes.

2. Enhancing Employee Trust

Timely and accurate EOSB payments build trust and foster a positive employer-employee relationship.

3. Financial Planning

Accurate EOSB calculations are crucial for financial planning and budgeting within the organization.

4. Reputation Management

Adhering to labor laws and treating employees fairly enhances the company’s reputation.

How Are End-of-Service Benefits Calculated in Dubai?

EOSB calculations in Dubai are based on an employee’s basic salary and length of service:

Gratuity pay is a key component of end-of-service benefits and is calculated based on the employee’s basic salary and length of service. A thorough understanding of the employee's basic salary is crucial for both employers and employees to navigate the end of service compensation effectively.

Service gratuity is a crucial financial entitlement for employees, defined as the payment made upon termination of employment, provided the employee has completed at least one year of continuous service.

1. For Less Than 5 Years of Service

21 days of basic salary for each year of service.

2. For More Than 5 Years of Service

21 days of basic salary for the first 5 years.

30 days of basic salary for each subsequent year.

3. Considerations for Termination

If an employee resigns, the EOSB amount may vary depending on their length of service and contract type.

For termination due to misconduct, employees may forfeit their EOSB.

The total gratuity is capped at the equivalent of two years' wages.

Process and Documentation

To ensure a smooth process when claiming end-of-service benefits, employees should follow these steps:

Review Their Employment Contract: Understand their entitlements as outlined in the contract.

Gather Necessary Documents: Ensure they have all required documents, such as proof of employment and termination.

Calculate End-of-Service Benefits: Use a gratuity calculator or seek legal advice to determine the accurate amount.

Submit the Claim: Provide all required documentation to their employer.

Receive Benefits: End-of-service benefits should be received within the specified timeframe, usually 14 days from the date of termination.

Employers should also maintain accurate records of employee service, including dates of employment, basic salary, and leave records, to ensure accurate calculation and payment of end-of-service benefits.

Voluntary End-of-Service Benefits Savings Scheme

The UAE government introduced a voluntary end-of-service benefits savings scheme in 2023, allowing employers to invest monthly end-of-service contributions in an authorized investment fund instead of making a lump-sum payment at the end of the employee’s service. This scheme aims to provide employees with a more secure and sustainable financial future.

Under this scheme, employers must:

Submit a Request to MoHRE: Employers need to submit a request to the Ministry of Human Resources and Emiratisation (MoHRE).

Select an Investment Fund: Choose and contract with one of the licensed investment funds.

Calculate Monthly Contributions: Determine the monthly subscription amount based on the employee’s basic salary and duration of service.

Transfer Contributions: Transfer the contributions to the investment fund within 15 days of the beginning of each calendar month.

Employees may also contribute voluntarily to the savings scheme, up to a maximum of 25% of their total salary. The scheme offers a range of investment options, including the Daman Investments End of Service Programme.

It is essential for employers and employees to understand the rules and regulations surrounding end-of-service benefits in the UAE, including the voluntary savings scheme, to ensure compliance with labor laws and a smooth transition at the end of employment.

Challenges in Managing End-of-Service Benefits

1. Regulatory Compliance

Staying updated with UAE Labour Law amendments is crucial to ensure EOSB compliance. The provisions of the UAE Labour Law regarding end of service benefits outline the eligibility criteria and calculations for gratuity pay for both Emiratis and foreign workers. Adhering to these legal stipulations is essential to avoid financial penalties and ensure compliance with employment regulations.

2. Accurate Calculations

Errors in EOSB calculations can lead to disputes and penalties.

3. Record-Keeping

Maintaining accurate records of employee tenure and salary details is essential for EOSB management.

4. Financial Impact

EOSB payments can significantly impact cash flow, particularly for businesses with a large workforce.

End-of-Service Benefit Solutions Offered by Young and Right

At Young and Right, we provide comprehensive solutions to simplify EOSB management for businesses in Dubai:

1. Accurate EOSB Calculations

Our experts ensure accurate EOSB calculations based on the latest UAE labor laws and employee records.

2. Compliance Monitoring

We help businesses stay compliant with UAE labor regulations, including UAE Labour Laws, avoiding penalties and legal disputes. Understanding and adhering to these laws is crucial for managing employee rights and end-of-service benefits effectively.

3. Financial Planning Support

Our team assists in budgeting for EOSB liabilities, ensuring smooth financial operations.

4. Employee Communication

We provide guidance on communicating EOSB entitlements clearly to employees, fostering trust and transparency.

5. Advisory Services

Our HR and legal experts offer advice on handling EOSB payments for different scenarios, such as resignations and terminations. This includes guidance on the specific regulations governing end-of-service benefits for workers in the private sector, ensuring compliance with legislation applicable to both Emiratis and expatriates.

6. Integration with Payroll Systems

We integrate EOSB calculations with payroll systems for streamlined processes and accurate reporting.

Why Choose Young and Right for EOSB Management?

As one of the best accounting firms in Dubai, Young and Right delivers unparalleled expertise and support for EOSB management. Here’s why we are the ideal partner for your business:

1. Expertise in UAE Labor Laws

Our team has extensive knowledge of UAE labor regulations, ensuring compliance in EOSB management.

2. Comprehensive Solutions

From calculations to compliance and advisory, we offer end-to-end EOSB management services.

3. Advanced Technology

We leverage cutting-edge tools to enhance accuracy and efficiency in EOSB processes.

4. Experienced Professionals

Our HR and payroll specialists bring years of experience to managing EOSB for businesses across various industries.

5. Client-Centric Approach

We prioritize your business’s success by offering personalized solutions tailored to your needs.

UAE labor law compliance

Including these keywords in your search helps businesses find the right partner for EOSB management.

How to Choose the Right EOSB Management Partner in Dubai

When selecting an EOSB management provider, consider the following factors:

1. Experience and Expertise

Choose a firm with a proven track record and deep understanding of UAE labor laws.

2. Comprehensive Services

Ensure the provider offers a full range of EOSB solutions, from calculations to compliance and advisory.

3. Technology Integration

Opt for a provider that uses advanced tools to automate and streamline EOSB processes.

4. Client Testimonials

Check reviews and testimonials to assess the provider’s reliability and professionalism.

5. Customized Solutions

Select a provider that tailors their services to your business’s unique needs.

Young and Right meets all these criteria, making us a trusted choice for EOSB management in Dubai.

Conclusion

Effective management of end-of-service benefits is essential for compliance, employee satisfaction, and financial planning. Young and Right Accounting and Tax Consultancy provides expert EOSB solutions tailored to your business needs. Contact us today to learn how our services can support your EOSB management and ensure compliance with UAE labor laws.